I got an email saying that I had suddenly got a charge on my credit card and wanting to know if it was me that did it.

I’m pretty sure it wasn’t me, my replacement card I got a few months ago after the old one expired is sitting on the little cabinet I use for a catch all that was my Dads and it is still unsigned and still has the sticker on it with the phone number to activate it on it.

I hate credit cards.

So I clicked on the link to dispute it and find that no, there is no charge there and Fuck You Very Much for scaring the shit out of me first thing in the morning.

There was a little message at the top of the screen saying that the people in this country who have ONE, credit card, owe over $7,000 on it.

Good Lord, these people are fucked.

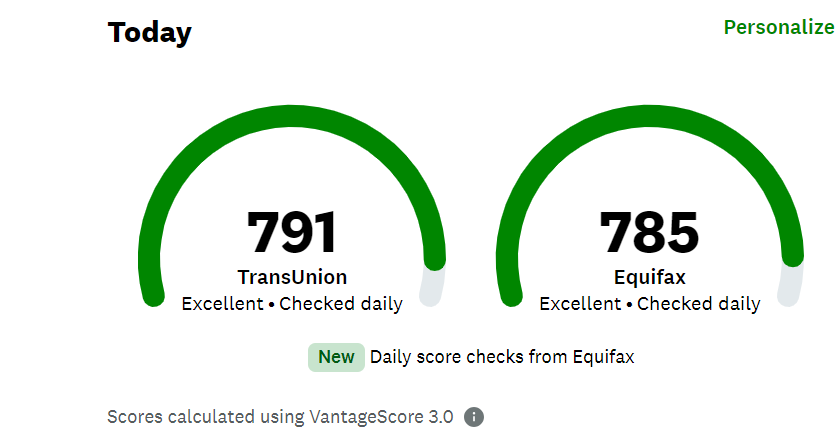

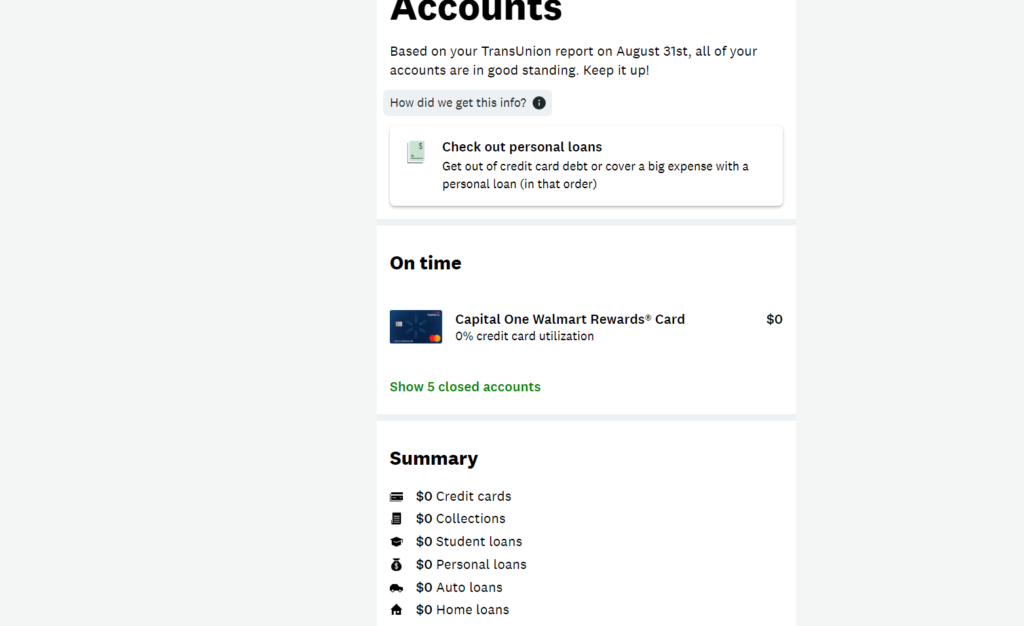

I did a Credit Karma check on my credit and found this.

All zeroes.

Just the way I like it.

Other than the monthly bills, I don’t owe anybody anything.

I can thank The Wifely Unit for that.

She is very frugal, pays our bills on time every month and gets on my ass constantly about spending money.

She pretty much has to, I am allergic to the stuff.

Although I’m pretty sure she carries a balance on hers.

When the Scandemic hit and I got laid off and they were sending an extra $600 for unemployment, she took that extra money and paid everything off instead of us just blowing the money on a new flat screen like some people.

I have used my credit card twice since then and paid it off at the end of the month both times.

They hate my ass because I don’t use it and have had 5 other accounts close for non use since then.

The current state of the economy is killing people, especially people with kids and especially people with teenagers who will eat you out of house and home because they are growing so fast.

Grocery bills are starting to equal what I used to buy junker cars for and drive away in.

I would love to retire but there is no way we can afford that right now. Inflation is killing everyone.

Still, having zero debt is going to go a long freaking way as the economy continues to shit the bed and roll around in it.

Update;

Dammit. Here I was bragging about not owing anybody anything…

I just remembered I owe those fucking doctors $2400 for the recent Endoscopy and Colonoscopy.

I just paid those medical bills off in June, another $2400, to catch up from LAST YEAR!

That’s why I couldn’t afford the $850 for Hosting fees.

So I am actually in the hole for that and am making payments on it every month.

Completely forgot about that until just a minute ago.

Even better, now the Vascular surgeon wants an EKG from the Cardiologist I have seen one time almost a year ago and yet another Cat Scan, which hits me in the ass for $1500 a pop, before she does surgery on me. Hopefully, fingers fucking crossed, that will happen in late October, early November.

So I’m not as debt free as I thought.

Shit.

I just got new tires for my truck. They cost more than any of the used cars I bought before 2000.

Congrats on zero debt. Me too, with the exception of a mortgage.

But the reason I’m commenting is…. ‘you clicked on a link in an email’!!! Are you nuts! Don’t use links in emails. Go to your bank’s website directly yourself, then find the page they’re talking about. It may take some time, but is a lot safer.

It was from Credit Karma, I have an account there.

Not just a random email.

What RD said. Even if it’s from a company I deal with, I use my own bookmark to go check out what they’re saying. They can all get hacked.

What everyone above said. I get links and email from extremely legit looking companies (FedEx, Chase, UPS saying that there are charges or deliveries that need my input when I know there are none. Invariably there are links of even things that look like PDF attachments. I delete them immediately or sometimes go look at the metadata to see what criminal country is in the delivery path just for grins. Italy seems prominent on scammer stuff. Head on a swivel, always.

yeah, are you SURE this wasn’t a Phishing attempt? IF you entered a name and/or passored, you might have given it away. ESPECISLLY since you DIDN’T find a charge.

Might be worth logging in and changin your password, just to be sure

Went and changed my password just in case.

The only credit card I have is a secured one linked to a seperate savings account specifically for the card…I’m borrowing against myself.

It gets paid off before the end of the billing cycle every month since that is what predominately use to pay the necessary bills…it keeps the credit score high.

I wish American people demand the federal government act financially responsible like THEY demand us to.

American citizens should boycott and block the federal government from spending more than they take in.

Having everything paid off is the only way I could have paid off the medical bills that accumulated from all the heart/lung drama and still have a roof over my head and eat within reason what I want to. I’ve got to start saving for those uncomfortable little surprises that life throws at you, again.

You can get a free credit report from the big 3 once a year. Get a report from one of them every 4 months, to check for anomalies. Put in a freeze with all 3 also.

I don’t even have a credit card. Don’t owe anybody nothing except my monthly utilities and such. I pay them by check.

I got rid of all my credit cards. A debit card works just fine for anything like a hotel or rental car reservation that requires a card. My only debt is my mortgage and it’s burning down fast. My 2021 TRD Off Road Tacoma will probably be my last vehicle and I special ordered it brand new and paid cash. By they way – contrary to everything I’ve heard, they were just fine with that at the dealership. It’s less paperwork for them and when the truck arrived it was already sold rather than being inventory they have to deal with.

Just another note on a slightly different subject. Credit Score is one of the main factors in determining if someone is eligible for a US Security Clearance. It’s getting harder and harder to find people who are qualified and can’t be leveraged because of debt.

i just started the process of locking my wifes and my credit with the 3 credit agencies, you can setup a free account and lock you credit. companies can see your credit info but no account can be opened until you unlock it..

Worth the time

forgot to mention, I DO NOT reply to bullshit like that. shit like that is how dumb shit gets on your PC

So I am actually in the hole ,,,

At least it’s Your “Hole”..

I would have a little chat with my physician and then separately with my surgeon to determine if all those procedures they want before surgery are REALLY required because sometimes, I found out the hard way, that’s the entity your doc works for making unnecessary shit up because they can get away with milking the cash cow.

The cash cow is the patient, or, in this case, it might be you……..

In my case it was an unnecessary MRI that my surgeon did N-O-T order and the time lag waiting for that bullshit procedure ended up postponing my hip replacement surgery 6 weeks.

Best to get out of being under a debt burden as quick as possible. We own our own home, 2 vehicles, and owe $0 to anyone.

If you owe and don’t know…

Pro Tip: Pay off your smallest debt, with whatever extra you have each month till it’s gone. Then work your way up to the next, and overpay till it’s gone too. Rinse repeat. Don’t fall for the “I have more money, time to improve my standard of living” trap, keep it simple till your free from the bank overlords.

Hosedeagger

Ah, the Dave Ramsey school of getting out of debt and STAYING out of debt !

The only debt you need is for a house and maybe a car, everything else is optional. Your “Standard of Living” may be lower, but at least you don’t have a debt burden on your back and can save and plan for emergencies.

P.S. – I recommend Silver and Gold as a hedge against the coming storm. Don’t have to buy a big chunk all at once, start with silver since it’s affordable (for now) and DON’T store it in a bank vault where you cannot get to it immediately when the balloon goes up. Same applies to YOUR money in a bank – the Gubmint can freeze it at any time (although Credit Unions are much. MUCH safer !).

And yet I know people who buy everything on their card. Everything.

And pay it off immediately. And rack up points for free travel or somesuch.

I’ve never trusted doing that.

That’s what I do. 2% Back on the main card and 3% on the gas card.

Paid in full every month. Banks call us deadbeats.

Us “deadbeats” are a happy lot, because we legally play their system without playing the game.

I *like* that!

But I do not use banks, they aren’t in my wallet. Credit Unions are the way to go.

I kinda screwed myself over a decade ago. Had a credit card I paid off, then never used it again. Then I paid off the remainder of my debts, and never applied for another loan.

For eight years.

Found out this year I had zero credit, and I mean the numbers came up as three big “X” marks because I refused to play their game.

I am far from rich, though I also have zero debts and even fewer wants or needs – divorce forces you to take a very savage look at what you hold value in.

Strangely, I receive at least three texts a week from my bank, asking me to make an appointment to apply for a loan – and they keep reminding me it is good for my credit rating.

Fuck that.

Fuck them.

Everything I have is mine. Period.

Uncovered medical expenses:

If you are willing to travel within about 100 miles (or more), then call all med facilities capable of the tests being ordered. Ask for pricing, compare and choose. We saved $880 on an MRI.

If you have a stash of mattress money, ask for a cash discount.

-mississloppigarro

I bet Mr. CederQ and that Glen Filthie character would tie you up on your favorite creeper and give you a “digital” colonoscopy for free! Bunch of old pervs.

Yer point?

I’m 59, and I’ve never had a credit card, and won’t. I have a debit card. It’s less convenient, but that’s my problem. I’ve taken out two loans in my life, both times to buy a house. Everything else I buy with money I have.

Cash back on my credit card just paid for two new cordless tools. My card gets hacked every year or two, I contest the charge, they deal with it and issue me a new card#. I pay it off every month. I like free money.

Yep. I like free money too. Everything possible is charged on one of two credit cards unless the business charges a surcharge. Gas, groceries, miscellaneous purchases, and recurring monthly bills all charged. Credit cards are paid off in full monthly. No credit card debt. I get 1-5% cash back on my purchases. Those credit card bitches are paying me hundreds of dollars a year to use their credit. Work the system man, work the system.

My CC company is screwing with me for being a deadbeat customer. I keep the balance paid every month in full, stretched out until 2 days before the due date to ride on their money as long as possible. In order to try and trap me into a missed payment they sent my e-statement with a $0 balance and no paper statement for the last couple of months.

I had to go onsite and wade through all of their bullshit to find my statements and make the payments as the barely understandable diversity hire “customer service” rep told me “We don’t do that over the phone anymore.”

My billing address had been changed, I didn’t do that and changed it back.

It now says my email address is invalid but the e-statements come through anyway.

Watch you backs folks. The majors are losing so much money on defaults they are going to try sticking it to people who can manage their money.

One million $35 late fee dings is 35 million dollars to them you know.

Rant Off.

Debt is a TOOL. In increasingly rare cases, you can use it to your financial advantage. Generally speaking those cases are straight forward and self evident where going into temporary debt makes sense. You use debt, rather than it using you.

The banks are not the only bad guys here. There are all kinds of morons borrowing money without a clue of the terms and conditions that go along with loans. It should be a law that blacks, women and retardscannot borrow without a co-signer. Another should be that politicians cannot meddle in loan practices… eg, Cackula Harris promising free gubbimint assistance with down payments. Jews should not be allowed into the national finances either.

I applied for a new credit card about 18 months ago. I had one at the time that I’d been using for twenty years or more. It paid rewards, but the rewards could only be applied to a very specific item.

I use a card as cash management tool and pay off the balance every month.

After I has applied for the new card, I started getting unsolicited offers in the mail for a new card from banks and other credit card companies. I must have gotten a dozen or so in the first couple of months and two dozen over a year’s time.

The card I have now pays rewards every month as a percentage of what is spent.

They also report my TransUnion credit score every month as part of the Statement.

One other thing on credit etc. You’ve all probably heard about the Social Security number hack that liberated every social security number in the date base. I went to the site referenced in the article as a place to check whether your number is in the hack. Mine was.

I was more than a little skeptical doing that as I thought, if I was a hacker, what better way to determine if the person was alive and has good credit than establishing a site where a person could check whether their number was part of the hack. That number and the person whose number it is would therefore be a target for fraud through bank loans, credit cards, mortgage fraud, deed transfer etc etc etc.

If you have a mortgage pull up a amortization form on line and insert your original loan amount and the original time. It must be a loan that is fixed rate. Find the month for your next payment. It will show your balance, then the interest you will pay that month. As you look you’ll see that the balance goes down and the interest grows. So, as an example, if you have 50K left on loan and your payment is $1,200. you would send in the amount required, that you pay each month ALONG with the INTEREST of the NEXT month. DO NOT send both written in the same check. It must come in separate like two money orders or two checks and one must state “Apply to Principle”. So whatever month you are in from original take the number of months left on life of loan and cut it in half. You have 10 years left it becomes a 5 year loan. Can’t make the entire principle send what you can. This all sound complicated but it’s so simple when it’s in front of you. Plus you can do this with any fixed rate loan. Got a 6 year car/truck loan do this and it becomes a three year loan. We did ARM and all types of loans and I only ever found it worked for fixed rate. Bankers know this and Hate to mention this as it cut’s the interest they collect to half. But be aware that the closer you are to paying this off the more interest your paying.

Actually, it works best when paying double principle. I paid off a 15 year mortgage in 6 years by paying the fixed rate plus one extra principle payment each month. Never let them refinance or adjust the monthly payment and by the third year, the loan begins to self destruct applying more and more of the regular payment to principle as you have screwed up the amortization schedule big time. Felt great to own free and clear.

re: MRI costs.

Call around. Tell them you need an MRI of “___” and what is the cash price. You may find that you get get one for less than your deductable at your regular provider.